Podcast: Play in new window | Download (Duration: 55:59 — 102.5MB) | Embed

Subscribe: Apple Podcasts | Email | RSS

Making investments in ourselves and our businesses takes confidence. A confidence not taught in the education system but instead typically left to our parents and mentors to pass on. These lessons aren’t always empowering as beliefs around finance and success differ through life experience. So where do we turn to to develop these skills and the confidence to make the right decisions with our money?

Tracey Sofra’s upbringing didn’t teach her how to build financial confidence, instead she learned it for herself and from doing so has developed a 7 step methodology to empower women to make finances a strength. In this episode we learn how Tracey became financially confident.

On The Dent Podcast, we interview key people of influence in all walks of life. We delve deep to unearth how these successful people got to where they are, their trials and tribulations, as well as their successes, and what their experiences can teach us all.

Tracey Sofra is Australia’s leading Financial Advisor specialising in women’s financial confidence. For over 3 decades she has worked with thousands of women across Australia to grow their wealth successfully and sustainably.

Tracey is the founder and CEO of WOW Women, the author of ‘Finding Financial Freedom’, a keynote speaker and the creator of the EMPOWER methodology.

Here’s a taste of Tracey Sofra and Glen Carlson’s conversation –

- Tracey’s origin story, from starting out as an accountant and going on to reach a position where she can help women to build financial confidence

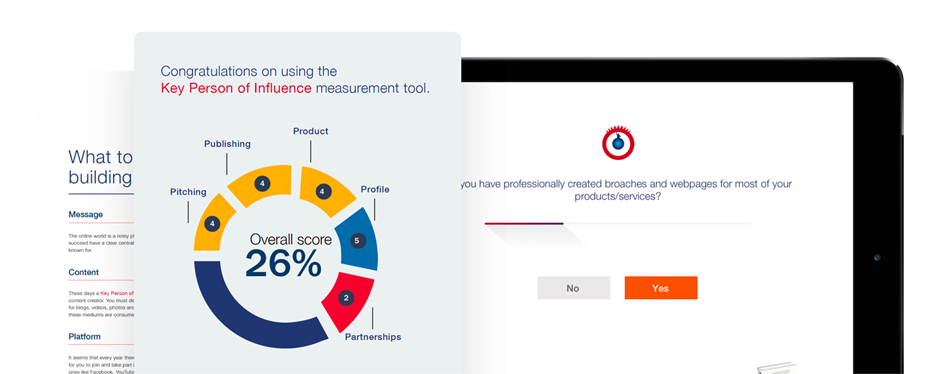

- Exploring Tracey’s business model and how joining the Key Person of Influence program helped her to pull the fragments of her business together and develop a framework for progression

- Challenging the lessons taught to us during our upbringings around the ideas of finance, careers and success

- Tracey talks about her financial confidence program and the 7 step EMPOWER methodology that it is built around

- Confidence when it comes to finances and how people lose it

- Understanding the difference between good debt and bad debt

- The origin of Tracey’s book ‘Finding Financial Freedom’ and how publishing a book has created more opportunities for Tracey to speak and engage within the financial and entrepreneurial spaces

- Utilising social media for its power of connection to develop a profile and engage with consumers and other industry professionals

- Tracey’s advice to women that are struggling with financial confidence

Links to connect with Tracey Sofra –