Podcast: Play in new window | Download (Duration: 1:09:08 — 95.5MB) | Embed

Subscribe: Apple Podcasts | Email | RSS

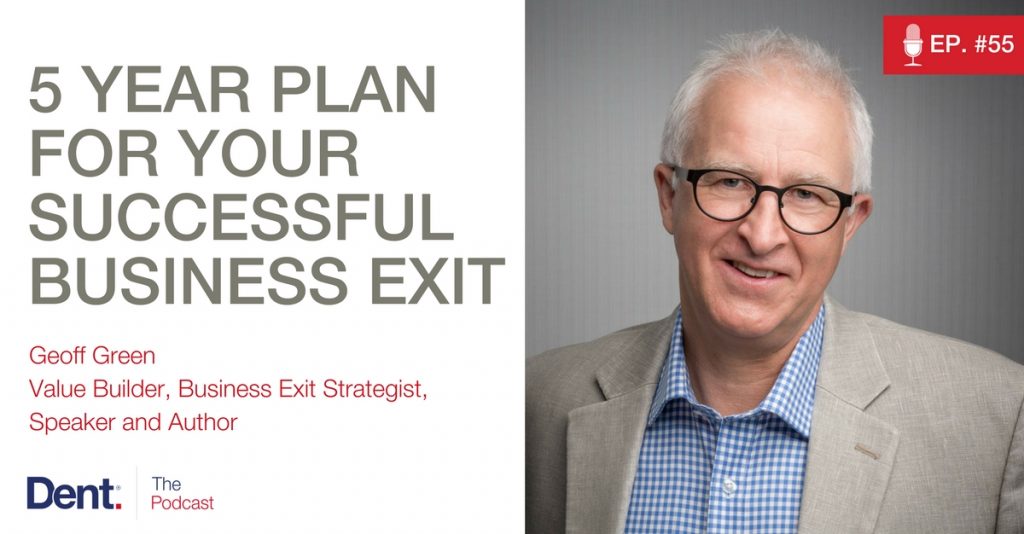

Have you ever thought about selling your business or acquiring another business? My guest in today’s episode is an expert exit strategist who has facilitated hundreds of transactions for exits, floaters, mergers and acquisitions, and private equity buyouts over his 30-year career. Now, over the last four years, Geoff Green has shifted to the development side of the equation to help business owners position their companies to be more valuable in a strategic exit. Geoff himself had his first business, an alternative stock exchange called Bendigo, initially valued at $140,000 that sold a few months later for $7.75 million.

In our conversation, Geoff explains how business owners can build and create new value, and how to ensure your business has transferable value for new ownership with a five year plan.

Additionally in this episode, we get really into…

- How Geoff became interested in the concept of business exit strategy

- The story of how Geoff’s first business increased its value from $140,000 to $7.75 million

- Unpacking the ideas of building, creating and transferring value

- Being clear on your expectations of what you want the legacy of your business to be

- Defining the three types of business owners and their advantages/disadvantages

- What makes a business valuable and the process of valuation

- The common challenges that owners face when trying to sell

- Why earnouts are to be avoided unless it gets you the full value of your business

- Evaluating the net promoter score

- Leaning on fellow business owners for advice and wisdom

- And much more

Resources

Geoff’s Website

The Smart Business Exit Book

Personalised Consulting Services

LinkedIn

Facebook

Instagram

Twitter